How to filter events on the forex economic calendar

How to Filter Events on the Forex Economic Calendar

Introduction

If you trade forex, you know data releases can swing prices in seconds. The forex economic calendar is like a crowded marketplace—events are everywhere, but only a few carry real move potential for your setup. Narrowing the view helps you stay focused, protect against surprises, and align trades across asset classes—from forex to stocks, crypto, indices, options, and commodities. In prop trading circles, dialing in this filter is a daily edge, not a gimmick.

Key filters you can apply to the forex economic calendar

- Impact level and volatility: Prioritize high-impact events (CPI, nonfarm payrolls, policy decisions) and treat medium/lowImpact ones as background noise unless your position is already in play.

- Currency relevance: Filter by the currencies you trade and their cross-pairs. A EUR/USD move might be quieter if you’re focusing on USD/JPY, but volatility in the euro zone can ripple across pairs you care about.

- Forecast vs actual, and prior: Compare consensus forecasts with actual data and the prior value to gauge surprise potential. A big deviation often precedes a breakout, but context matters (risk sentiment, liquidity, time of day).

- Time zones and session overlap: Align events with your local trading window and the most active market sessions. Overnight releases can create gaps or whipsaws when liquidity is thin.

- Event type and tone: Separate macro data from central bank speeches and minutes. Read the language in statements for shifts in policy bias, not just number changes.

- Market context: Consider holidays, liquidity squeezes, or other concurrent events. Even a high-impact release can be less consequential if the market is already positioned for a bigger picture theme.

Practical steps to set up filters in your workflow

- Build a focused watchlist: Start with a core set of currency pairs and related assets. Add a secondary list for potential follow-ups during major news weeks.

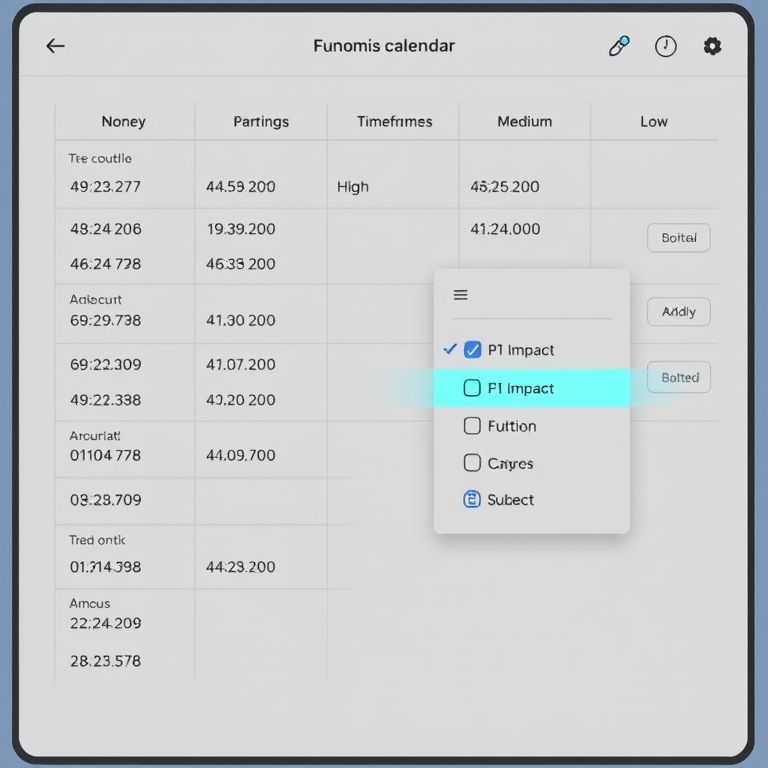

- Calibrate filters in your calendar tool: Use impact tags, time filters, and currency relevance. Pair this with your chart time frame to plan entries around expected volatility.

- Cross-check with price action and volatility: Before trading, scan recent candles, average true range (ATR), and liquidity conditions to judge whether the calendar signal lines up with technicals.

- Backtest your rules: Look at historical releases similar to the event you’re watching. If a rule would have avoided misreads or improved risk management in past cycles, it’s worth keeping.

Real-world scenarios you’ll encounter

- A US CPI release spikes volatility in USD pairs; a clean filter might trigger only if the surprise exceeds a threshold and the price is already trading near a key level. This minimizes overtrading during a one-sided move.

- ECB policy decisions can shift the euro broadly, but filtering for language cues in the press conference helps separate lasting shifts from knee-jerk moves.

- Ongoing data revisions or speeches can set up gradual tilt rather than a sharp spike; filtering for certainty in the narrative helps avoid chasing noise.

Advantages across asset classes and learning for prop traders

- Cross-asset awareness: A tidy forex calendar enhances understanding of how news ripples through stocks, crypto, indices, and commodities, sharpening your multi-asset decision-making.

- Risk discipline: Clear filters support defined entry/exit criteria and position sizing, vital in prop trading where risk control is foundational.

- Real-world adaptability: Traders who can translate a data surprise into a coherent plan on several markets gain an edge when volatility sweeps through correlated assets.

Reliability, strategies, and risk ideas

- Use multiple sources for data sanity checks and combine calendar signals with price action and market sentiment.

- Predefine stop-loss and adverse move rules, and size positions to withstand typical intraday swings around news events.

- Practice variant strategies (trend continuation, mean reversion, or hedged exposure) that fit the event profile and your risk tolerance.

DeFi, AI, and the evolving landscape

- Decentralized finance adds data challenges: oracle reliability, cross-chain delays, and liquidity fragmentation. Timely, trustworthy feeds become part of your edge when traditional calendars prove noisy.

- AI-driven tools promise smarter filtering, scenario analysis, and pattern recognition across calendars and markets, though you’ll still want human oversight for risk judgments.

Prop trading prospects and promotional cues

- The best prop desks blend disciplined filtering with rapid execution, using calendars to time liquidity events and defend risk limits. A crisp mantra: filter with intention, trade with precision, scale with discipline.

- Slogans to keep in mind: Turn the calendar into your edge. Trade the signal, not the noise. Smarter filters, sharper outcomes.

Bottom line

Filtering the forex economic calendar is less about chasing every release and more about shaping a reliable framework that scales across asset classes. As markets lean more on data, a thoughtful, disciplined approach to filtering can sharpen your edge in forex and beyond, while staying resilient in a rapidly evolving, sometimes decentralized, financial world.

YOU MAY ALSO LIKE