Is acid testing reliable for precious metals?

Introduction

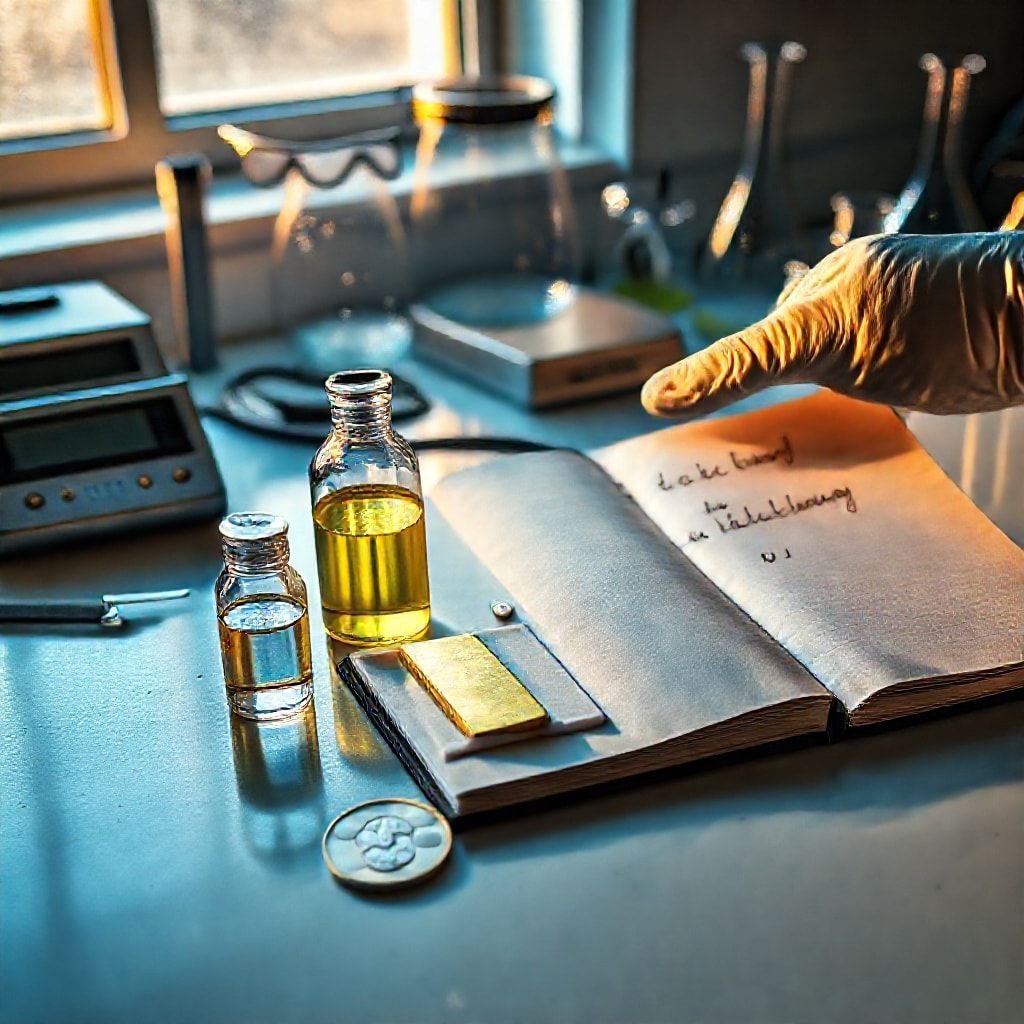

Imagine walking into a sunlit storefront where every ring glints with possibility, and a trusted bench technician leans in with a tiny bottle of nitric acid. The test they perform aims to separate real gold from clever imitations. Acid testing has long been a staple in valuing precious metals, but in today’s fast-moving markets—especially with Web3, tokenized assets, and cross-asset trading—the question rises: is acid testing reliable enough on its own? The short answer: it’s a vital first filter, but not a catch-all. In this piece, we’ll unpack how the acid test works, where it shines, where it trips you up, and how traders today blend old-school methods with cutting-edge tech to navigate a complex, multi-asset landscape.

Body

How the acid test works in real life

In a typical bench scene, a jeweler applies a precisely measured drop of nitric acid to a tiny sample or to a test spot on the metal. The reaction—or its absence—speaks to the metal’s karat rating and, by extension, its authenticity. The logic is straightforward: genuine gold or silver alloys behave differently than base metals when exposed to acid. A seasoned tester looks for color changes, bubbling, or other cues, and then cross-references with hallmark records, weight, and dimensions.

What makes the test useful is its speed and portability. You don’t need a lab to get a ballpark read on a piece in your hands. For a small dealer or a pawnshop operator, acid testing can separate likely gold from a counterfeits outer shell quickly, enabling a next-step decision: pull out a more definitive assay or pass on the item.

Limits you should not ignore

- Plated or clad items challenge the test. A layer of gold plating over a base metal can resist the acid briefly, fooling a quick read. If the plating is thin or if the item has a complex core, the test might mislead you.

- High-karat alloys and mixed metals complicate interpretation. 18K, 14K, or 10K gold are blends; the acid’s reaction depends on chemistry, thickness, and distribution of metals. A mismatch between appearance and acid result isn’t rare.

- Environmental and handling factors matter. The acid concentration, surface area exposed, and even the presence of oils on the skin can skew outcomes. Testing on a dirty or polished spot can produce false positives or negatives.

- It’s destructive to a small degree. The acid test leaves a tiny mark, which may affect value in some contexts. For vintage pieces, mint condition and provenance matter.

Modern reliability tools you can pair with acid testing

- X-ray fluorescence (XRF) spectrometry: handheld XRF devices scan a surface and identify the elemental composition without removing material. It provides a more granular read on karat, alloy mix, and potential plating.

- Fire assay (for high-stakes valuation): a laboratory method that yields highly accurate results, often used for precise karat determination. It’s more involved and slower, but it’s a trusted standard for quality assurance.

- Fine-scale metallography and HK tests: in some cases, cross-sections and microscopic analysis reveal plating thickness and core material, clarifying ambiguous cases.

- Provenance and certification alongside tests: serial numbers, assay reports, and hallmarks from reputable labs add a lot of confidence when combined with physical tests.

From bench to boardroom: applying acid testing in the Web3 era

Web3 and tokenized metal markets are changing how people think about authenticity. In a world where you can trade tokenized gold, futures on metal prices, or crypto-backed commodity derivatives, the reliability of on-chain data must mesh with real-world guarantees. Acid testing remains a practical on-the-ground check—especially for physical pieces bought or held outside traditional custody—but it’s increasingly supplemented by digital assurances:

- Token provenance and on-chain metadata offer an auditable history of a metal’s origin, assaying, and custody events. This reduces the risk that a piece is misrepresented before it hits the market.

- Price oracles and cross-validated data feeds underpin DeFi metal products. If a tokenized metal’s value is pegged to an on-chain price plus verified assay data, the reliability of that data becomes critical.

- In a diversified trading setup (forex, stocks, crypto, indices, options, commodities), a physical audit, digital provenance, and robust risk controls together tell a fuller story than any single method.

DeFi development: opportunities and hurdles

The decentralized finance space brings new liquidity pools, synthetic assets, and cross-chain trading for metals, but it also introduces new risk vectors:

- Oracle risk and data integrity. If the feed that ties a metal token to its real-world value is compromised, prices can swing unexpectedly. Redundant feeds and cross-checking with trusted sources help mitigate this.

- Regulatory and custody challenges. DeFi products tied to precious metals must navigate securities, commodities, and anti-money-laundering rules. Clear custody arrangements and compliant KYC/AML steps build long-term trust.

- Liquidity fragmentation. Tokenized metals may live in multiple pools or chains, making it harder to achieve efficient pricing and slippage control. Aggregation layers and standardization efforts are shaping where liquidity concentrates.

- Security and smart contract risk. Vulnerabilities in staking, minting/burning, or collateral systems can create sudden losses. Audits, formal verification, and modular risk controls are increasingly common safeguards.

Case anecdotes and practical takeaways

- Anecdote: A small jewelry trader trusted a local bench test for quick reads but paired it with XRF confirmation for high-value pieces. The combination helped catch a misleading “18K” claim where the core was alloyed copper but plated to look like 18K. The tester saved a costly mislabeling error and kept the shop’s reputation intact.

- Anecdote: A collector engaged in tokenized precious metals built a workflow that relied on on-chain provenance plus periodic live testing of rare items. The mix reduced the odds of fakes slipping into a portfolio, while still allowing on-chain trading to flow smoothly.

Reliability in a multi-asset trading world

When you step back, acid testing is one piece of a larger reliability framework. In a market with forex, stocks, crypto, indices, options, and commodities, the competitive edge comes from correlating physical verification with digital signals:

- Combine physical checks with digital provenance. If you buy a tangible metal or a token tied to a metal, demand a verifiable assay report, serial literacy, and custody proof, then cross-check with the issuer’s on-chain data.

- Use multi-method authentication. Acid tests for a quick screen, XRF for composition, and lab-grade assays for final confirmation on high-value lots. This layered approach reduces false positives and enhances confidence.

- Build a risk-aware leverage strategy. In volatile markets, leverage magnifies both gains and losses. Use conservative margin levels, diversify across asset classes, and backtest any leveraged approach across different market regimes.

Practical strategies and risk tips for traders

- Do not rely solely on the acid test. It’s a fast screen, not a final verdict. Always corroborate with XRF results or lab assays for valuables, especially when high premiums or unusual inventories are involved.

- Calibrate expectations for plating and alloys. If you suspect plating or a non-standard alloy, request a full spectral analysis or a lab-certified assay before pricing.

- Structure your risk around asset class realities. In forex and commodities, macro drivers matter more than micro-test results; in tokenized metals, the reliability of on-chain data and custody matters as much as physical authenticity.

- Manage leverage with discipline. Start with modest leverage, define clear stop-loss rules, and consider hedges in correlated assets (e.g., gold and gold-backed tokens) to smooth drawdowns.

- Embrace technology without losing the human touch. Charting tools, AI-driven signals, and advanced analytics can guide entries and exits, while physical verification ensures the piece you’re trading or holding is what it claims to be.

- Watch for chain and protocol risk in DeFi. If you’re trading tokenized metals, keep an eye on oracle reliability, contract upgrades, and liquidity depth. Diversify across platforms when appropriate.

Future trends: smart contracts, AI, and the evolving landscape

- Smart contract trading for metals. Automated minting, collateralized tokenization, and on-chain arbitration could streamline settlement and increase liquidity while maintaining checks against counterfeit risk.

- AI-driven trading for metal assets. AI can identify pricing anomalies across physical and tokenized markets, helping traders spot mispricings between on-chain data, spot prices, and LME or COMEX benchmarks.

- Enhanced provenance via AI and sensors. IoT-enabled custody, tamper-evident seals, and AI-assisted auditing could deliver real-time assurance on metal authenticity and location.

Slogans and framing for credibility

- Trust the metal in your hands and the data behind it.

- Provenance you can see, tests you can trust, markets you can navigate.

- Old-school accuracy, new-school confidence.

- Real-world proof, on-chain clarity.

Conclusion

Is acid testing reliable for precious metals? As a standalone method, it’s a valuable first filter—fast, portable, and hands-on. But in a modern trading ecosystem that spans multiple asset classes and blends on-chain and off-chain data, it works best when used as part of a layered reliability approach. Pair the acid test with XRF or lab assays, demand provenance, and leverage digital tools to manage risk across the board. In the Web3 era, where tokenized metals, crypto-backed instruments, and traditional markets intersect, the goal isn’t to chase a single silver bullet. It’s to weave together physical verification, digital provenance, and robust risk controls so you can trade with confidence—and to promote a headline-worthy, trustworthy narrative along the way: Is acid testing reliable for precious metals? Yes—when it’s part of a broader, smarter framework.

Promotional note: for traders and collectors who value accuracy in a complex market, the slogan stands: trust the metal, trust the data, trade with insight.

YOU MAY ALSO LIKE