Examples of good testimonial questions for clients

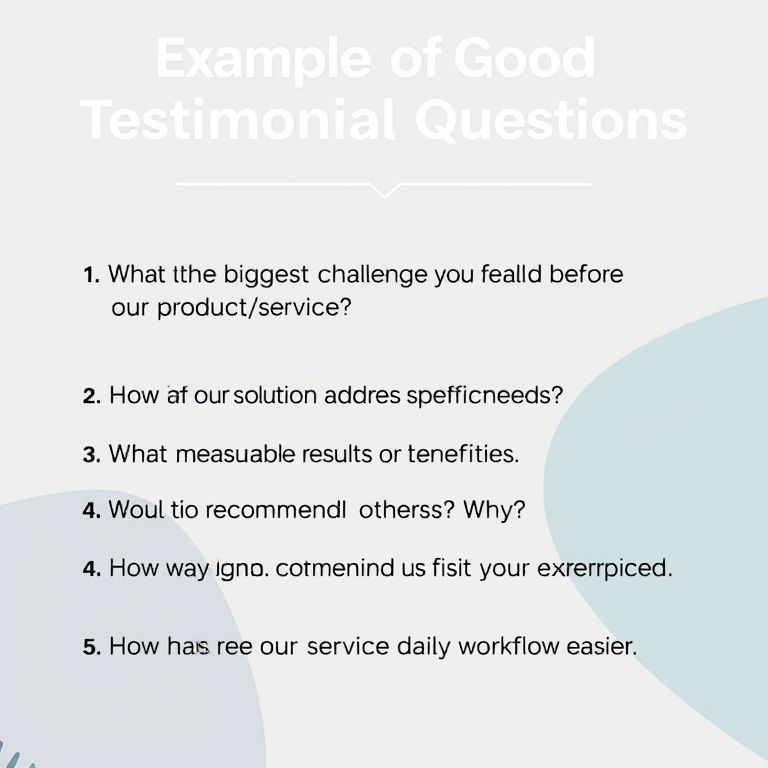

Examples of Good Testimonial Questions for Clients

Introduction

When you run a prop trading desk, client stories aren’t just testimonials—they’re proof of how strategies perform in real markets. Asking the right questions helps you surface concrete outcomes, risk management practices, and the human experience behind every trade. This guide offers practical questions you can tailor to forex, stocks, crypto, indices, options, and commodities, with eye toward DeFi, smart contracts, and AI-driven trading futures.

What makes a testimonial question strong

- Behavior-based and specific: ask about actions, not vibes.

- Outcome-focused but honest about risk and timing.

- Grounded in real scenarios (market regimes, volatility, drawdowns).

- Clear about context (account size, time frame, asset class).

- Open enough to tell a story, but structured enough to compare results across clients.

Asset-class focused prompts

Forex

- Can you share a period where a defined risk rule kept losses small while exploiting a trend? What did that rule look like in practice?

- Describe your most challenging drawdown and how the strategy helped you stay disciplined.

- Which metric best captured success for you: win rate, risk-adjusted return, or execution quality?

Stocks

- What portfolio balance shift, if any, did you make after adopting the model, and what was the impact on volatility?

- Tell me about a time you avoided a sharp move thanks to a stop or hedging approach you learned here.

- How did the approach affect your capital preservation during earnings season?

Crypto

- In a volatile month, what evidence did you see that risk controls kept you within target drawdown?

- Share a win where you capitalized on a liquidity-driven move without overstaying the trade.

- What role did liquidity assessment play in your decision-making?

Indices

- Which regime (trend vs range) did you navigate most effectively, and what signals triggered a switch in approach?

- How did you measure diversification benefits within index-based trades?

- Can you describe a moment where backtesting aligned with live performance?

Options

- How did you structure leg risk or volatility exposure to protect downside?

- Give an example where a theta/vega view helped you capture time decay or volatility spikes.

- What trade you’re most comfortable recommending to a colleague, and why?

Commodities

- When supply/demand news caused a spike, how did a predefined risk plan keep you in bounds?

- Share how you used calendar spreads or cross-commodity relationships to mitigate risk.

- What’s a concrete example of a position that worked because you respected carry and roll costs?

Reliability and strategy insights from testimonials

- Describe a single decision you changed after onboarding that improved consistency.

- What’s one metric you monitor daily, and how has it shaped your approach?

- How did the training miss or confirm your prior assumptions about market behavior?

DeFi, challenges, and the evolving landscape

DeFi is expanding the toolkit—decentralized liquidity pools, cross-chain protocols, and transparent price feeds change how traders access markets. Clients often praise speed and openness but flag concerns about counterparty risk, smart contract bugs, and regulatory clarity. Real-world notes include: the value of audit reports, the importance of upfront risk disclosures, and the need for clear contingency plans if liquidity dries up.

Smart contracts, AI, and the future of prop trading

Smart contracts automate rules and settlements, reducing manual friction. AI adds pattern recognition, risk assessment, and adaptive sizing. Clients appreciate when testimonials highlight how automation preserved discipline during fast moves, or how AI helped prune overtraded ideas. Expect more hybrid models: human judgment guided by transparent, auditable algorithms.

Promotional cues and slogans

- Turn client stories into trusted proof.

- Real outcomes, real discipline, real growth.

- See how tested questions unlock clear performance narratives.

- From story to strategy: let testimonials guide your next trade plan.

- Trusted voices, verifiable results.

Conclusion

Testimonials grounded in concrete questions become a compass for future clients. They reveal not just profits, but process, risk controls, and learning curves across asset classes, today’s DeFi realities, and tomorrow’s automation-backed trading world. If you align your questions with real experiences, you’ll build credibility that translates into confidence and steady growth in the prop trading space.

YOU MAY ALSO LIKE